This article is the first in a series where we cover the whole factoring invoicing process and how to design it using smart tech. You will learn how to automate manual repetitive tasks, gain deeper insights and increase control. Give your employees, customers, and their debtors a smooth user experience.

Five main steps

We’ve divided the invoicing process into five main steps. Each step has its own quirks and technical demands. We will go through each one of them and describe how to handle the subprocess optimally. In this article we will focus on the first step: Financing Request.

We’ve divided the invoicing process into five main steps. Each step has its own quirks and technical demands. We will go through each one of them and describe how to handle the subprocess optimally. In this article we will focus on the first step: Financing Request.

Continue reading the factoring series:

Step 2 Distrbution

Step 3 Reminders & Collection

Step 4 Payments

The difference an optimized flow makes

The difference an optimized flow makes

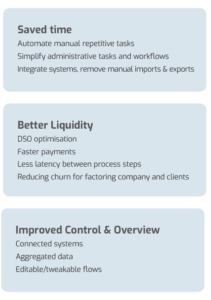

The impact a well-designed, automated, and optimized invoicing flow can have on your factoring business is substantial. Not only does it improve the day-to-day work for your operations and management team. It also affects your client’s business, as well as their debtors in a positive way.

Factoring covers three different user experiences, and if done correctly this can create positive effects throughout the UX chain.

Financing request: Generate & Approve Invoice

This step can look a lot different depending on the type of client and if they have a large or small amount of invoices, as well as if their invoices are complex or simple.

complex or simple.

We will talk about how you can optimise the process of fetching and creating invoices. We will not talk about how you can design retro looking 90s stickers to put on your clients’ invoices to tell the debtor that the invoice is handled by a factoring company. This is too old-school and tacky. What we want is professional looking invoices that displays both the debtors’ and your brand in an optimal way.

If we want to achieve minimal manual labour in this step, we should aim for solutions that automatically fetch, interpret, and create the client’s invoice for us. This could be achieved through mainly 2 different approaches.

The first approach is connecting a software that interprets invoices sent to an inbox or uploaded to a server. Even if this solution is far better than having to manually enter all invoice information to create a new one, there is still a risk for errors in the interpretation, and that vital information is missing. This is why we recommend that you – if possible – always aim for the second approach, which is a solution where you are integrated with the clients ERP. This way all the necessary information from the invoice can be fetched and automatically entered into your invoice handling software, making it much easier generating invoices and modifying the layout and design.

Continue reading and get the 360 view of the factoring process for free!

Continue reading and get the 360 view of the factoring process for free!

This article only touch one part of the whole factoring process. The get the whole picture, download our free white paper on how to create an optimal Factoring Invoicing Process.

Assemble your own Factoring platform

At Quiddly we develop and license complete cloud based systems for Factoring, Invoicing and Debt Collection. Our concept is simple, but the solutions are advanced.